With this blog post, we are highlighting the Change in Spectrum Holdings feature of our National Carriers - Spectrum Holdings reports. In this report, we detail the spectrum holdings for each of the national carriers, including Dish, and USCellular. The first segment of the report details each carrier's future holdings, tracking the effects of all pending FCC transactions. The second segment of the report details each carrier's current spectrum holdings. Using each of these segments, we provide a Change in Spectrum Holdings segment which highlights the CMA markets where a carrier's spectrum holding are increasing (+) or decreasing (-) because of filed FCC transactions.

In the view above, from August 2016, you can see the summary details for the spectrum additions and subtractions for each of the national wireless carriers. This view highlights a spectrum trade between Sprint and T-Mobile in the Cleveland market (5 MHz) as well as the T-Mobile's pending 700MHz A-Block transactions.

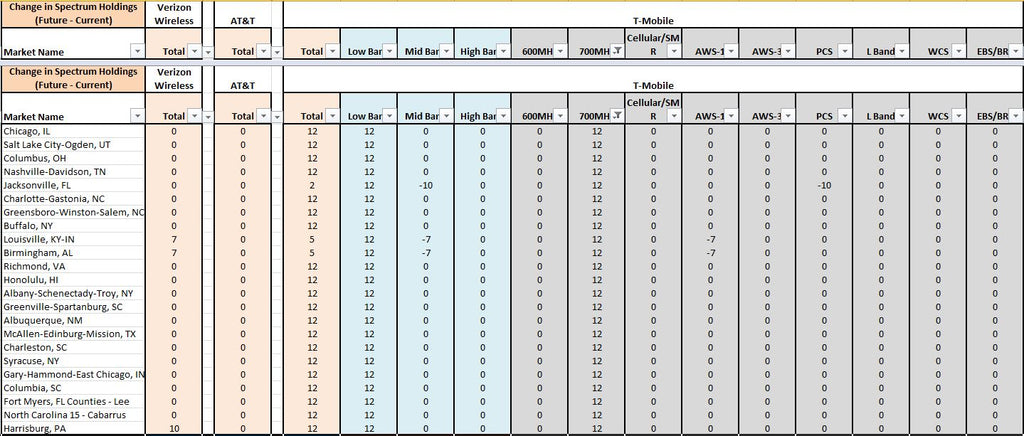

The view above details the band classifications (low, mid, or high) and the frequency band that contribute to T-Mobile's 12 MHz increase in spectrum. The August 2016 report concludes that the transactions for all of the listed market names are still pending.

Now looking at the September 2016, the Allnet's Spectrum Ownership Analysis Tool has updated the transactions that were consummated during August 2016. The only pending 700MHz - A Block transaction is T-Mobile's purchase of Laser in Chicago, IL.

For the cost of a monthly subscription to the National Carrier - Spectrum Depth Reports ($495/mo), the monthly effect of pending and closed transaction can be seen and evaluated.

These graphs detail the peak capacity for downlink files and streaming video for the four major national wireless carriers plus Dish and USCellular. They illustrate the peak capacity on a market-by-market basis. In creating the graphs, I anticipate the usage of each wireless carrier’s total spectrum available, not just the spectrum they have dedicated to LTE at this time. These graphs allow you to see the significant capacity advantage that Sprint will have once they deploy their 2.5GHz spectrum. They also provide a market-by-market comparison of AT&T and Verizon capacity. You can see that AT&T has a capacity advantage versus Verizon in all Top 20 markets except Minneapolis-St. Paul. In addition, you can see the relatively low capacity that T-Mobile is able to offer and the capacity that Dish could provide after they launch a network.

I was able to construct these graphs by using Allnet Insights and Analytics Spectrum Ownership Analysis Tool determine the number of LTE channels that each carrier’s spectrum can support.

Assuming that each LTE channel had the follow achievable LTE Peak Data Rates:

These rates were applied to each of the carriers LTE channels to create a total peak downlink throughput. For all EBS/BRS spectrum (Sprint’s 2.5GHz spectrum), I assumed TDD (Time Division Duplex) LTE operation and each channel’s throughput was reduced to 75% to reflect the 75:25 downlink to uplink ratio for TDD operation. TDD LTE utilizes a single radio channel to both transmit to the mobile device (downlink) and transmit from the mobile device (uplink). In TDD LTE timeslots, similar to the wedges on the Wheel of Fortune, carry either downlink traffic or uplink traffic during that time interval. Since internet traffic is typically 75% downlink and 25% uplink, US operators dedicate 75% of the wedges to downlink and 25% to uplink. Most US spectrum bands are configured for FDD (Frequency Division Duplex) LTE, which utilizes two radio channels, one to transmit to the mobile device (downlink), and one to transmit from the mobile device (uplink).

In the charts below, we present the current carrier aggregation plans for AT&T, Verizon, USCellular, Dish, T-Mobile, and Sprint. Green indicates that particular frequency block is used one time in the aggregation scheme. Yellow indicates that particular frequency block is used twice in the aggregation scheme. For both the green and yellow highlights, only one carrier can be utilized in each frequency block. The blue highlights indicate that multiple carriers can be utilized in each frequency block (non contiguous).

AT&T

Verizon

T-Mobile

Sprint

Dish

US Cellular

AllNet's Spectrum Ownership Analysis Tool has been updated to include all of the AWS-3 auction results in all of its Analysis Modules. Below in the Spectrum Grid Module, you can see which carrier acquired the spectrum rights for each of the uplink channels in the Top 5 CMA markets.

The screenshot of the downlink channels also provides a view into where Dish's AWS-4 spectrum fits with their new AWS-3 spectrum.

In support of the upcoming auctions we have included the available AWS3 channels in our Spectrum Grid worksheet and we have added both a CMA and EA Market Report.

In the Spectrum Grid you can see the primary spectrum owner for any spectrum band, including the adjacent AWS1 band, at a county level. The CMA Market Report displays the spectrum holdings for 8 selected carriers utilizing the Cellular Market Area (CMA) geographic boundaries. The EA Market Report displays the spectrum holdings for 8 selected carriers utilizing the Economica Area (EA) geographic boundaries. For both of these reports, AllNet's county-level data is population weighted averaged to either the CMA or EA markets.

Spectrum Grid (AWS3 Portion)

CMA Market Report

EA Market Report

Although it surprised the wireless industry a bit, it does make sense that Sprint saw a declining value in the H block spectrum. Acquiring that spectrum would have allowed Sprint to expand their primary LTE Channel from a 5x5 channel to a 10x10 channel. In terms of Mbps, from 37 Mbps per sector to 73 Mbps per sector. If this could be added to the network today, it would bring Sprint to about par with the other 3 national carriers. The problem is timing. It will be mid-2014 before the spectrum will be awarded to the auction winner, but prior to receiving the spectrum, the high bidder could start the 18-24 month process to get the LTE band classifications changed. Sprint would either have expanded the frequencies for their band 25 or requested a new band classification that would include all of the old PCS block, the PCS G block, and the PCS H block. With the standards body work, including carrier aggregation, it would likely by early 2016 before network upgrades would begin. This coincides with their forecasted completion of Project Spark. If Sprint completes this project on-time, they will have 38,000 sites that will be enabled with 40MHz of 2.5GHz spectrum, which could be a game changer. This does seem to signal that Sprint doesn't think their PCS G LTE is particularly strategic.

With AT&T's announcement that they are meeting some challenges related to testing operation between LTE Band Class 29 and Band Classes 2 and 4, I figured that many readers would appreciate a reference map for how these band classes relate to the US mobile radio and satellite spectrum bands.

All of these screenshots are from the AllNet Labs Spectrum Ownership Analysis Tool, where we display and provide analysis tools related to spectrum ownership for all of the US mobile radio and satellite spectrum bands for all 50 states and US territories.

AllNet Labs Spectrum Ownership Analysis ToolIn the images below, the band classes are color coded Gray for Uplink Spectrum, Yellow for Downlink Spectrum, and Blue for Spectrum supporting Time Division Duplex.

700MHz Spectrum

SMR/Cellular/L-Band Spectrum

AWS/PCS Spectrum - Uplink

PCS/AWS Spectrum - Downlink

WCS/EBS/BRS Spectrum

Recently I reviewed the 3GPP Standards site to check in on the status of LTE Carrier Aggregation. I found a gold mine of information.

First a few definitions: Carrier Aggregation allows a wireless carrier to band together different blocks of their spectrum to form a larger pipe for LTE. This can be accomplished in two ways: Inter-band and Intra-band.

Inter-band combines spectrum from two different bands. The spectrum in each band to be combined must be contiguous within that band. Intra-band combines spectrum from two non-contiguous areas of the same band.

Here is a link to an article from 3GPP that explains Carrier Aggregation.Below is a table summarizing the relevant 3GPP working group descriptions for Carrier Aggregation.

First of all, the current network release for all carriers is Release 9. T-Mobile, Sprint, and Clearwire have announced that they are deploying Release 9 equipment that is software up-gradable to Release 10 (LTE Advance). From the chart, it does not appear that there are any carrier configurations planned until Release 11. Release 10 appears to be a late 2013 commercial appearance and Release 11 will likely be very late 2014 or mid-2015. For Carrier Aggregation to work it must be enabled and configured at the cell site base station and a compatible handset must be available. The handsets will transmit and receive their LTE data on two different spectrum bands for the Inter-band solution. All handsets currently only operate in one mode, 700MHz, Cellular, PCS, AWS, or 2.5GHz.

Highlights by Carrier:

Canada: Rogers Wireless will have support for inter-band aggregation between their AWS spectrum and the paired blocks of 2.5GHz spectrum.

AT&T: Inter-band support in Release 11 for their Cellular and 700MHz spectrum, inter-band support to combine their AWS and Cellular spectrum, as well as configuration to support combining their PCS and 700MHz spectrum. All of the 700MHz band plans only include their 700B/C holdings. No 700MHz inter-operability.

USCellular: Inter-band support in Release 11 for Cellular and 700MHz (A/B/C). No support for PCS or AWS spectrum combinations

Clearwire: Intra-band support for the entire 2.5GHz band. China Mobile is also supporting this with an inter-band aggregation between 2.5GHz and their TDD 1.9GHz spectrum.

Sprint: Support in Release 12 for combining (intra-band)their holding across the PCS spectrum, including their G spectrum but not the un-auctioned H spectrum. No band support for their iDEN band or the 2.5GHz band.

T-Mobile: Support in Release 12 for intra-band in the AWS band and inter-band between AWS and PCS.

Verizon: Ericsson appears to be supporting Verizon's need to combine (inter-band) between AWS and 700MHz C. Not support for Verizon's Cellular or PCS holdings.

Dish: Release 12 support to combine their S band (AWS4) spectrum (inter-band) with the 700 MHz E holdings. This is the only aggregation scenerio for the US that combines FDD operation (AWS4) with TDD operation (700MHz E).

Dish's counter-offer for Clearwire is intriguing. I recently completed a presentation detailing the challenges of a spectrum sale in the EBS/BRS spectrum. Clearwire's press release states that this offer was on the table when Sprint's offer was received but Sprint's offer was deemed better.

Tim Farrar's Blog indicates that the spectrum sale would likely be for Clearwire's BRS spectrum. This is a realistic assumption. In my presentation (linked in a previous blog) I highlighted that one of the primary problems with the leased spectrum is that it has limited geographic coverage, covering many of the dense metro areas but not contiguous all the way to a county or BTA border. There are still a few elements of a BRS spectrum sale that should be understood.

From the image above, the BRS spectrum sale would include the Orange (BRS1/BRS2) channels, the Pink (E channels), Light Blue (F channels) and Brown (H channels). This would equate to one contiguous block of 55.5MHz of spectrum, a 12MHz block of spectrum (E4,F4), and the isolated BRS1 channel. The 12MHz block could only be used if mid-band video operations have ceased in a market. Currently, I don't believe that any of the Top 10 markets have completed ceased video operations. The 55MHz of spectrum can support 2 - 20MHz TDD-LTE channels. This would virtually eliminate the ability to utilize the EBS/BRS spectrum for any FDD-LTE operations. It may be possible with a guardband in the H channels to operate the D channels and G channels in a FDD-LTE configuration.

In looking at the LTE Bandplans, the potential Dish spectrum allocation would miss the international TDD-LTE Band 38 which Softbank, China Mobile, and the UK auctions are using. We will have to watch carefully to see if international devices will include functionality of Band 41.

My last area of concern is whether that will leave enough spectrum for Clearwire to continue to operate their WiMax network as they bring their TDD-LTE network online. Additionally, with the geographic limitations of the leased channels, there may be a limited number of sites operating on Clearwire's network today, that won't have available spectrum without the owned channel spectrum.

Inevitable. If you have followed the Sprint/Clearwire saga since they were joined with Google, Time Warner, Brighthouse, Comcast, and Intel; it was obvious that Clearwire had a hard road ahead. In yesterday's announcement Erik Prusch indicated the depth of the internal concern; Clearwire had retained an advisor to provide options for restructuring.

Once the carrier consolidation of 2012 occurred, the only path forward I saw for Clearwire was funding minimal operations into the 2014 time frame, with a hope that the other 3 national players would finally need the wholesale access to Clearwire's spectrum. With each of the national players, except Sprint, lining up their LTE capacity growth spectrum, the need for wholesale access to Clearwire's WiMax or planned TDD-LTE network was unnecessary. Clearly Sprint needed Clearwire for its LTE growth spectrum and at $0.21/MHzPOP I believe we will look back 5 years from now and view this was steal. Not only has Sprint put in concrete their LTE capacity growth, but they have cornered the market available spectrum for years to come. When you consider that Clearwire controlled 160MHz of spectrum which could be expanded to nearly 200MHz in most metro areas with additional spectrum leasing and spectrum purchases, Sprint has the only meaninful swatch of "new" spectrum that will come to market in the next 5 years.

I don't see the Broadband Incentive auction, the Dish spectrum, or the recent 3.5GHz spectrum as meaningful for efficient macro network coverage. Those subjects are covered in other blogs.

The purchase of Clearwire does not guarantee smooth sailing for Sprint. Sprint still has very significant short term issues. Their LTE network is 5X5 which is the smallest of any of the national carriers. In addition, their customers with WiMax devices will continue to transition over to this network as they upgrade their devices. Clearwire's TDD-LTE hotspot network is only at the construction start stage, with likely very limited coverage throughout 2013. Clearwire has talked historically about devices arriving for this network 2Q or 3Q 2013. Thus, there won't be any material movement of traffic from Sprint 3G or LTE network until early 2014. From what I experience on my Sprint Samsung S3, the 3G network is already challenged and LTE is not available in my market (Seattle). It will get worse before it gets better.

The idea of Clearwire hosting Dish's AWS2 spectrum seems to be bouncing around the news pages today. Clearly (no pun intended), Clearwire operates a 4G network that is very similar to Sprint Network Vision concept. With the necessary zoning and permitting, Clearwire could add this spectrum band with a new set of antennas and tower top base stations. So, this would get Dish to market after they pass the standard's body requirements for defining the new band, but what does it provide Clearwire. Different than Sprint, they don't need the spectrum, they need capital to increase the TDD-LTE build out. I believe that Clearwire would much rather Dish sign up for their wholesale mobile broadband service with an infusion of capital. My next blog will look at one of the other drawbacks for potential wholesale partners like Dish with Clearwire's TDD-LTE plan. Check back later in the week.

On the surface, a deal to host Dish's spectrum on Sprint's Network Vision platform would make alot of sense. The chart below highlights that part of Dish's (DI) spectrum is adjacent to the AWS-2 spectrum that recently has been referred to as the PCS H spectrum. Sprint is interested in acquiring this spectrum to increase their LTE channel size from 5x5 FDD-LTE to 10x10 FDD-LTE. Unfortunately, the Dish spectrum is configured where the uplink (from the handset to the cell site) would be adjacent to Sprint's LTE downlink (cell site to handset). This will be problematic for Dish. Cell sites transmit at much higher power than handset signals are received. Expensive filters on the separate Dish antennas may not be enough to allow the Dish antennas to be installed in the same plane (level) as the Sprint antennas.

You can look at this as being similar to the Lightsquared deal, except Lightsquared was planned into the deployment through the zoning and permitting process. With the standards body processes that are in front of Dish, it would still be years before equipment is installed and a network operating on Sprint's towers. A Dish MVNO to operate on Sprint's 3G Voice and LTE network would allow Dish to get a wireless product to market quickly.